TD Ameritrade Review – Should You Check Them Out?

If you’re new to trading, this TD Ameritrade review will explain why you might want to check them out. TD Ameritrade is a broker that offers no minimum investment and six types of accounts, including a virtual trading simulator. In addition, it offers research and education services. If you’re looking for a broker that specializes in education and research, a better choice would be Merrill Edge. Then there’s E-Trade, Fidelity, and Merrill Edge. And, if you’d rather use a broker with a larger selection of stocks, you can go with Interactive Brokers.

TD Ameritrade is a broker with no minimum investment

TD Ameritrade is a great option for investors who want to learn more about the financial markets. This broker offers no-minimum investments and no commission fees on stock and options trading. The company has over three hundred branches across the U.S. and has received numerous accolades. While this type of platform can be overwhelming for a total novice, more experienced traders will appreciate the flexibility and ease of use.

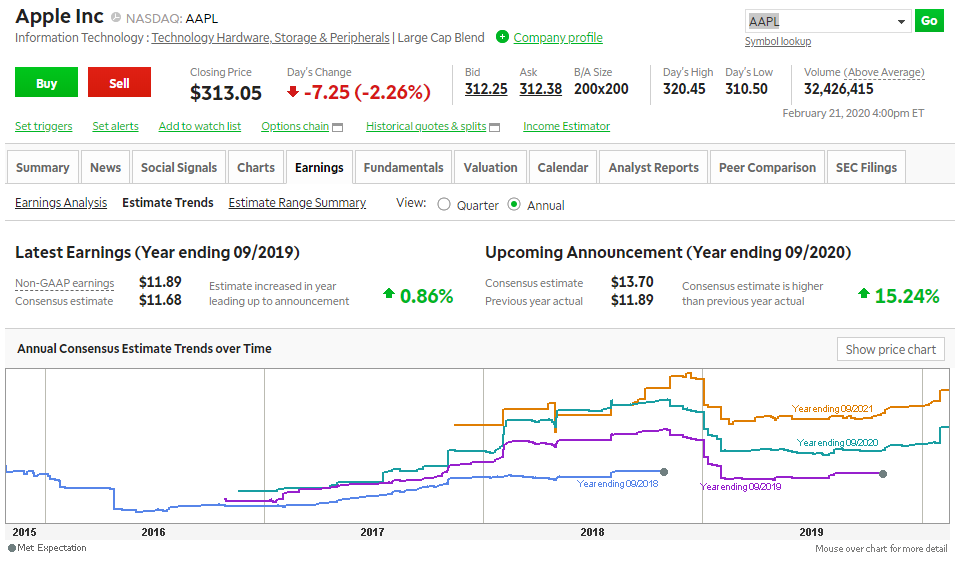

TD Ameritrade offers traders several platforms such as Saxo Bank Review. The desktop platform is the easiest to use, and you can access your order ticket by logging in. A basic stock transaction involves entering the ticker symbol, the number of shares, and the price. You can also access market news from other sources. TD Ameritrade also supports 24/5 trading, and has 400,000 global data points at your fingertips.

It offers six types of accounts

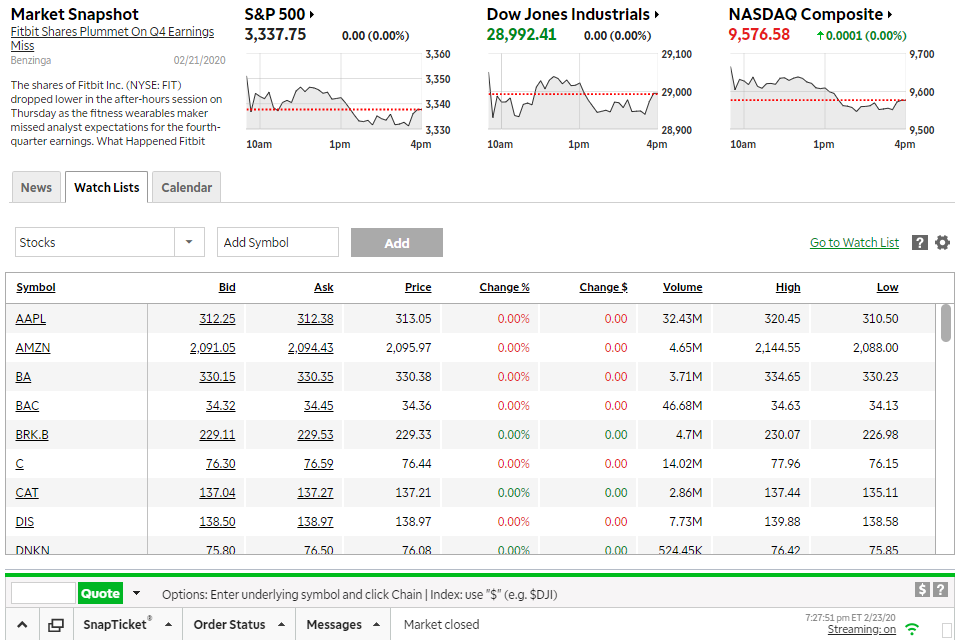

TD Ameritrade has six different kinds of accounts, each with its own advantages and disadvantages. Some account types offer higher interest rates than others. TD Ameritrade’s basic account offers a 0.01 percent interest rate. In comparison, the basic checking account at a large bank only offers 0.01 percent interest. However, many of the top exchange-traded funds and savings accounts offer higher rates.

TD Ameritrade offers self-directed, managed, retirement, education, and specialty accounts. Most of these accounts require no minimum balance to open. Some of these accounts also have commission-free mutual funds. There are also advanced accounts available, including forex, options, futures contracts, and even cryptocurrency. All of these accounts require no minimum balance, and they are accessible online. In addition, you can use their mobile app to make trades on the go.

TD Ameritrade provides an app for iOS and Android. You can manage your account online, but if you prefer the convenience of a mobile device, you can download the mobile app. The app displays your account balance and position details on a single page. Scrolling down the screen allows you to view general market news and information. TD Ameritrade offers around-the-clock customer service.

It offers a virtual trading simulator

TD Ameritrade’s Review paperMoney virtual trading simulator provides a virtual environment in which you can practice your investment techniques. The simulator mimics a real trading platform and includes everything from complex stock and options trades to various chart indicators, studies, and fractional shares. This is an excellent tool for educating yourself before investing real money. It comes with $100,000 of virtual currency and a 60-day trial period for you to test it out.

To use thinkorswim, all TD Ameritrade products are available. It includes live trading, practice trading, and futures. You can also view charts and graphs. Unlike other online trading platforms, this simulated environment is free of charge. You can access the simulated market from any computer with a web browser. To get started, just login to thinkorswim and follow the instructions on the screen.

It charges high margin rates

While both TD Ameritrade and Interactive Brokers charge hefty margin rates, the difference is only in the scale of the fees. The former charges nearly 10% while the latter charges less than 4%. The only significant difference between the two is the amount of risk incurred by the broker. While most brokers impose maintenance margin requirements of 25% or less, it’s important to remember that bad days can blow past this limit. This is because positions above 25% MMR may gap up or down more than the amount of money required to cover the gap. Also, if the market is fast, it’s unlikely that your position will fill close to its gap open price.

TD Ameritrade offers margin accounts with a minimum deposit of $2,000, but the interest rate is much higher than average. A margin account at TD Ameritrade is charged at a rate of 7.75%, and the maximum rate is 9%. It’s also worth noting that there’s virtually no short list for this brokerage. In addition to the high margin rate, new traders may be overwhelmed by the large amount of information available on their website. For this reason, new traders might prefer a simplified platform or another brokerage.

Related Posts